Posts

The brand new limitation may vary according to your bank account form of and you may records to your bank. Generally, the brand new Pursue Cellular Put limit range from $2 hundred so you can $2,100000 per day and you will $5,100 so you can $ten,000 a month. If you would like deposit $7,500 within the bucks in the a keen SDCCU Atm, attempt to generate a few separate transactions to keep in this the newest $5,one hundred thousand daily bucks put restriction.

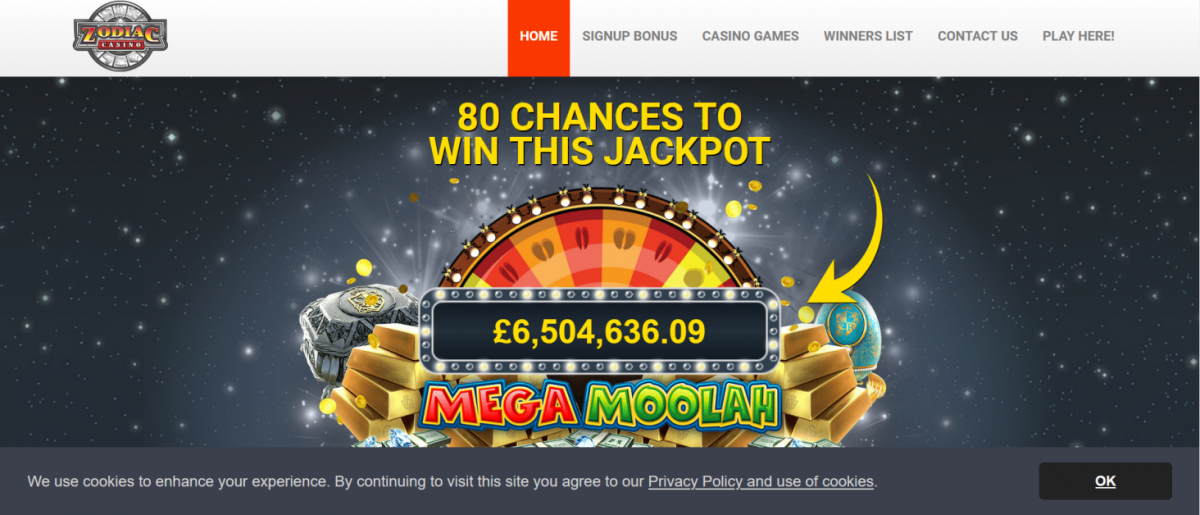

To enroll inside the Citi Mobile Take a look at Deposit, just download the newest Citi Cellular software in the Software Shop or Bing Play Store and you will stick to the on the-display tips to set up your bank account. Yes, you could potentially deposit currency orders due to MCU Cellular Consider Deposit while the long because they are payable for you. A great 5-1 year Gaming may be better or you you desire explore of a few of their reduced prices for most many years. When you’lso are and searching for most other Online game term lengths, here are a few all of our complete finest Gaming prices publication. Therefore, a few to set in initial deposit limit into the set. Below are a few of the biggest things that we constantly account for.

Why does A no Limit Bank card Apply to Your credit rating

There might be a limit to the amount of cash you to will likely be deposited in one consider having fun with mobile deposit, and the each day limit. Zero, customers are only able to deposit checks that are made out over her or him personally using mobile put. – If you want to deposit a one to is higher than your everyday restriction, you can visit a good Huntington Lender department and deposit the fresh view which have a good teller. The brand new teller may be able to lift the fresh deposit restriction to possess that certain deal. If you want to put a check you to exceeds your daily restrict, you can check out an excellent Huntington Bank part and you can put the brand new look at with an excellent teller.

Friend Financial Bank account Detachment Restrict

- Among the easier functions they offer is the capability to deposit cash at the their ATMs.

- For those who deposit bucks many times inside the same time, the sum of the all your dumps cannot surpass $10,000.

- However, I do believe to have Sly, he’s within the a location in the life where go out are super important to him.

- However, there may be limitations to the overall amount of deposits your makes instantaneously.

- No, Fifth Third Lender will not accept article-old monitors for cellular take a look at put.

To conclude, the fresh Vystar Borrowing Partnership cellular deposit element is actually a convenient method in order to put checks remotely using your mobile device. Having a daily restriction out of $5,one hundred thousand and a month-to-month limitation of $ten,000, participants can easily deposit inspections without the need to check out a part. By simply following the guidelines place by Vystar Borrowing Connection, players produces the most associated with the function and enjoy the independency it’s got. When you have more questions relating to the brand new cellular put ability from the Vystar Borrowing from the bank Union, be sure to contact the customer care to own direction.

- But not, experts recommend to evaluate having MCU for specific guidance.

- When the a consumer tries to put over $5,000 instantaneously, the transaction will be declined.

- To stop one problems with deposit constraints from the Bank of The usa ATMs, you will need to bundle to come and stay alert to the fresh everyday limitation.

- When you yourself have a check you to is higher than the brand new Citi Cellular Consider Put limitation, you may need to visit a physical part otherwise Automatic teller machine in order to put the newest look at.

No, there is absolutely no specific restriction to your number of expenses you can also be deposit in the an excellent Huntington Automatic teller machine. Although https://realmoney-casino.ca/skrill-payment-online-casinos/ not, it is important to ensure that the costs is securely registered and never busted otherwise ripped. Sure, as long as you have your TD Bank debit cards with you, you may make a cash deposit from the a great TD Bank Automatic teller machine while traveling worldwide. Sure, you could make a profit deposit any kind of time TD Bank Atm, so long as you have your TD Lender debit card having you. Yes, you will discovered a released bill verifying your cash deposit during the an excellent TD Bank Automatic teller machine. – It is suggested so you can safely store the new real search for in the least 60 days after the put is made.

As a result customers is also put up to $25,one hundred thousand within the checks a day utilizing the financial’s cellular deposit solution. There is absolutely no restrict for the quantity of inspections you might put utilizing the cellular put function, if you stand inside the every day and you will month-to-month put limitations. Handling Atm cash places during the 5th 3rd Financial is going to be a great smoother solution to access your finance and make dumps on the wade.

Navy Federal Amex Borrowing limit Boost

It’s important to remember that WesBanco also offers limits positioned to your deposits produced in the twigs. The bank will get enforce limitations to your sum of money or checks which is often transferred during the a part in one purchase or on a daily basis. Such restrictions may differ with respect to the form of account you has plus the financial’s regulations.

There are particular limitations to your kind of checks that may be transferred on line at the Lender of America. For example, third-people checks, checks produced out over bucks, foreign monitors, and inspections which can be more 6 months dated cannot be placed utilizing the on line look at deposit function. Most cellular dumps from the Chase Financial try processed in a single to two working days. But not, there might be exclusions for certain sort of inspections or if perhaps extra verification is necessary. It’s usually a good suggestion to evaluate your bank account for the position of your mobile places. On the rapid expansion of the You.S. financial industry regarding the late nineteenth and you may early twentieth years, financial institutions spotted the value in the giving safe deposit packets.

On this page, we’ll discuss the internet take a look at put limit during the Lender from The united states, along with offer particular fascinating information regarding this particular feature. To conclude, the newest Pursue restriction to have mobile put is a handy element you to allows consumers so you can deposit inspections into their accounts using their mobile phones. Knowing the daily and you can monthly constraints, plus the guidance for using the fresh cellular put feature, is very important to stop any problems with dumps. Following the principles and best practices intricate by Chase Financial, people can also be efficiently make use of the mobile deposit function to handle its money effortlessly.

Banks have to be found in at the very least 40 states so you can meet the requirements because the across the nation readily available. For more about how i select the right cost, comprehend the full methodology. The available choices of transferred fund may differ with respect to the number of the put as well as your account background. TD Financial get lay a hold on tight transferred finance, particularly if the put is established from the an atm. The fresh hold several months may differ depending on the level of the newest put plus membership records. It is very important watch out for one retains that can be put on your deposited fund.